Insurance often feels like a distant, impersonal necessity—something we purchase out of obligation, file away, and only revisit when something goes wrong. For many, the experience is transactional, dominated by paperwork, policy jargon, and automated systems. But at its core, insurance is about people. It’s about protecting lives, livelihoods, and aspirations. Making insurance feel more human means reimagining how it’s communicated, delivered, and experienced. It’s about shifting the focus from contracts to connections, from coverage to care.

One of the most powerful ways to humanize insurance is through empathy. Behind every policy is a person navigating life’s uncertainties. Whether it’s a parent securing their family’s future, a business owner safeguarding their operations, or a young adult buying health coverage for the first time, the decision to insure is deeply personal. When insurers recognize this and respond with genuine understanding, the experience changes. A claims process that begins with “How are you doing?” rather than “What’s your policy number?” sets a different tone. It acknowledges the emotional weight of the moment and builds trust from the outset.

Communication plays a central role in making insurance feel more human. Too often, policyholders are met with dense language and confusing terms that create distance rather than clarity. When insurers speak in plain, conversational language, they invite people into the conversation. Explaining coverage through relatable scenarios—like how renters insurance helps replace stolen electronics or how travel insurance covers unexpected medical expenses abroad—makes the concept tangible. It’s not about simplifying the product; it’s about making it accessible. When people understand what they’re buying and why it matters, they feel more connected to their coverage.

Personalization also enhances the human element. Insurance should reflect the unique circumstances of the individual or business it serves. A newlywed couple has different needs than a retiree, and a freelance designer faces different risks than a manufacturing firm. When coverage is tailored—when it feels like it was designed with someone’s life in mind—it becomes more relevant and meaningful. This requires thoughtful engagement, not just checkboxes. It means listening, asking questions, and crafting solutions that align with specific goals and concerns. The result is a sense of partnership rather than a one-size-fits-all transaction.

Technology, while often seen as a barrier to human connection, can actually support it when used thoughtfully. Digital platforms that allow users to manage policies, file claims, and access support in real time offer convenience and control. But the experience must be intuitive and responsive. A chatbot that answers questions clearly, a dashboard that shows coverage details in plain terms, or an app that provides timely updates during a claim—all of these tools can foster engagement and reduce stress. When technology is designed with empathy, it enhances the human experience rather than replacing it.

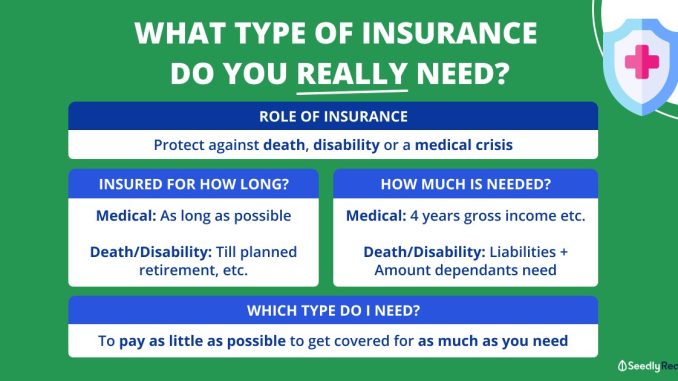

Education is another key factor. Many people avoid engaging with insurance simply because they don’t understand it. By offering clear, engaging educational resources—whether through videos, articles, or interactive tools—insurers can empower customers to make informed decisions. This isn’t just about compliance or sales; it’s about building confidence. When people feel knowledgeable, they’re more likely to ask questions, explore options, and take ownership of their protection. Education turns insurance from a passive product into an active part of someone’s financial and personal strategy.

The human side of insurance is especially important during moments of crisis. Filing a claim often comes at a time of stress, loss, or uncertainty. The way insurers respond can either ease that burden or add to it. A compassionate voice, a clear explanation of next steps, and a willingness to go the extra mile can make all the difference. These interactions aren’t just about resolving issues—they’re about reaffirming trust. They show that the insurer sees the policyholder not just as a customer, but as a person.

Cultural sensitivity also plays a role in making insurance feel more human. Different communities may have different attitudes toward risk, protection, and financial planning. Language barriers, historical mistrust, and economic disparities can all influence how people perceive and engage with insurance. By acknowledging these factors and designing outreach that is inclusive and respectful, insurers can build bridges rather than barriers. This might mean offering materials in multiple languages, partnering with local organizations, or training staff to recognize and respond to diverse needs. When people feel seen and respected, they’re more likely to connect with insurance in a meaningful way.

Ultimately, making insurance feel more human is about restoring its original purpose: to provide care, support, and peace of mind. It’s about recognizing that behind every policy is a story, and behind every claim is a person. When insurers prioritize empathy, clarity, and connection, they transform the experience. Insurance becomes less about obligation and more about empowerment. It becomes a relationship built on trust, understanding, and shared responsibility. And in a world full of uncertainty, that kind of human connection isn’t just valuable—it’s essential.